0 2 min

Solutions

Alternative Asset Classes & Structures

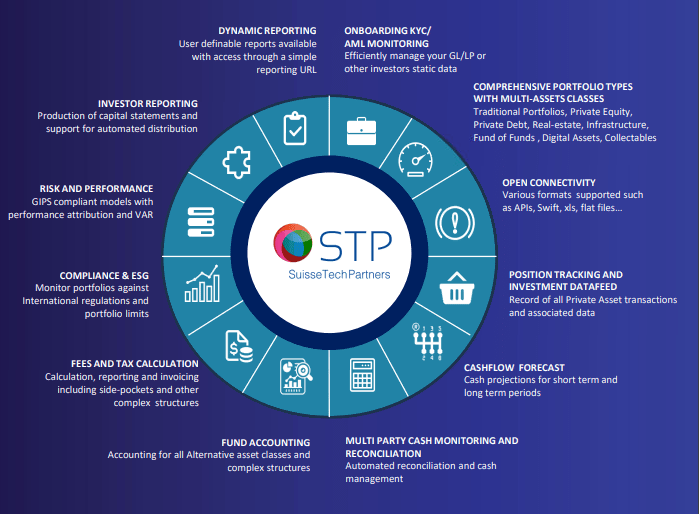

PMplus® provides comprehensive and integrated management of alternative assets.

PMplus® is a robust solution for all your alternative investments needs, it streamlines and centralizes the entire investment process in the ever changing regulatory landscape. A fully integrated solution suite, covering all major alternative asset classes (PE, RE, Infra, HF & Private Debt) for all alternative investment professionals (GP, LP, AS, FOF & VC).

PMplus® offers one centralized location to easily onboard and manage investors, track the lifecycle of all financial asset types, performance, analytics, fund accounting and produce multi-lingual reporting and to manage due diligence / workflow processes. PMplus® facilitates the calculation of fee’s and performance figures which then feed a flexible invoicing tool.

With customizable workflows and strong security measures, PMplus® simplifies new partner onboarding, secure documentation management, capital calls, and distribution processes. General Partners can effectively manage complex multi-level investment structures using PMplus®.

Moreover, PMplus® stands out for its exceptional ability to support a wide range of asset classes whether those are private or public securities, including extensible reporting capabilities for assets such as real-estate and collectibles. By leveraging its real-time general ledger capabilities, the software enables accurate tracking and reporting across diverse investment types, providing valuable insights for General and Limited Partners alike. PMplus® empowers General Partners to seamlessly calculate performance figures and fees and to generate invoices for payment. Such invoices can be multilingual as PMplus® supports all international character sets and is built as a full Unicode application.

With the power of PMplus®, private equity firms gain a comprehensive and efficient tool to optimize their operations and fiduciary reporting responsibilities. Our platform’s streamlined workflows and real-time monitoring capabilities enhance transparency and simplify complex processes that are otherwise time consuming and prone to error. Through PMplus®, firms can seamlessly integrate partnership structures, monitor operations in real time, and demonstrate an efficient operating base. Overall, PMplus® empowers professionals to navigate PE challenges, ensure efficiency, transparency, and growth in their operations.

In summary, PMplus® offers a comprehensive solution for managing private equity investments and partnership structures. By leveraging the capabilities of PMplus®, professionals in the industry can optimize their operations, make informed decisions, and drive success.

PMplus® Overview

An 'all-in-one' solution for portfolio management

PMplus® is an innovative cloud-native solution developed by SuisseTechPartners, an international financial technology company with teams located in Geneva, Luxembourg, UK, Singapore, Hong Kong, Hanoi and Kosovo.