The regulations governing the duties of Depositaries / Trustees have not evolved too much over recent years. While the set of regulatory duties is quite clear and shared globally within the Industry, the demands on providers continues to increase as regulators seek more proof of ‘test and verify’ activities, at an ever greater depth of review.

Obviously, there can be some nuances like the obligation for a Depositary Bank in Germany to recalculate the NAV but these are exceptions which could evolve into more widely adopted standards over time.

Indeed the complexity of their mission has heavily increased due to the pressure set by the regulators to perform tighter / more frequent controls, while pressure continues to be exerted in the area of cost efficiencies.

In this particular context, we, at SuisseTechPartners (STP) see a growing interest from Depositaries / Trustees to optimize / reinforce their operational and IT set up to increase their monitoring and review activities to meet their growing regulatory obligations.

As we will see later on, we are convinced that our software PMplus® is one of the most efficient and modern solutions on the market to support the evolution of the activities of Trustees / Depositary Banks and implement additional controls at a reasonable incremental cost.

1. The regulatory duties of the Depository Bank / Trustee

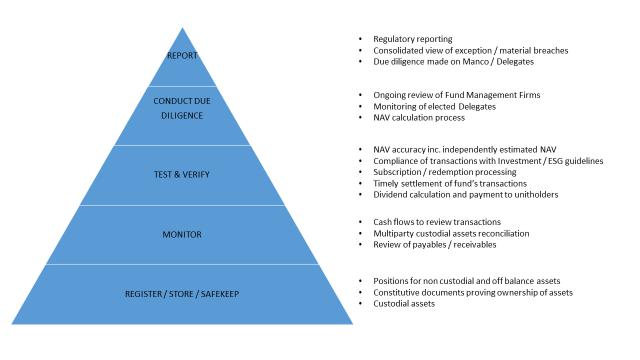

Before looking at the solutions, it is useful to recapitulate the functional requirements. The following pyramid gives an overview of the current main duties of a Depositary / Trustee:

2. The current complexities / difficulties to cope with

The combination of the pressure set by the regulators, the evolution of the business mix with the growth of Private Assets, along with the need for cost efficiencies is pushing the service providers to find new solutions to meet the following obligations:

- Perform additional sample spot checks to ensure that the Management Company and / or its delegates follow adequate procedures for key processes such as NAV calculation or compliance monitoring. In that domain, Germany is one step ahead as the actual recalculation of the NAV by the Depositary is done independently from the Asset Manager is market practice,

- Reinforce controls on ownership of assets and the existence of positions for assets such as Real Estate or the look through multiples layers of SPVs in a Private Asset Fund,

- Ensure consistency of controls and reporting across platforms used to monitor actual delivery of services and meeting of key performance indicators,

- Potentially replace outdated platforms and / or modify current operating models to ensure a full segregation of duties vertically and horizontally through the global organization,

- Meet the challenge of new requirements in domains which are still unclear or face lack of clean data to perform controls, such as for the compliance with ESG guidelines and regulation,

- Deliver their previously agreed obligations while keeping resources as flat as possible and even shoot for cost savings while making no compromise on quality and servicing.

Obviously, all these points do represent major challenges for the actors of the industry as, at the same time, they need to onboard new business and to manage IT upgrade projects in parallel, while mastering delivery costs.

3. The main objectives to meet

Many of the World’s largest Depositaries / Trustees are currently reviewing their operational and IT set up in order to cope with the different points described in the previous paragraphs and to define a new target model delivering the following objectives:

- automate end to end processes using complex transaction filtering to identify potential outliers and workflow processing,

- implement consolidation layers and multi-layer dashboards to regroup info coming from different platforms vs trying to migrate to a target platform and thus favor timing of delivery,

- outsource some of the operational task and the IT services to transform fixed costs into variable costs while retaining the accountability for the output,

- provide more user definable and timely reporting of outstanding reconciliation breaks to favor a speedy resolution,

- facilitate the monitoring of the ongoing activity for the managers to fulfill their regulatory duties, the delivery of on-line information to all participants of the value chain using a user defined formats and reporting,

These objectives can sound ambitious but they are the price to pay to remain competitive in the Depositary/Trustee business and to prepare for future demands. Indeed for those Depositaries /Trustees that

have an ambition to monetize their infrastructure and to win business that is not tied to their in-house administrator, these are fundamental requirement to ensure that a competitive offering is available.

4. The new solutions coming up on the market

Solutions such as our PMplus® software have been built using the most recent development languages, providing an efficient tool kit to help a Depositary / Trustee to face its duties and meet its operational requirements. There are some key words that we hear in most discussions, and that can be seen in most ‘Requests for Proposal’:

- Trustee data consolidation solutions which will acquire, cleanse and consolidate information coming from different platforms to deliver a unique set of data using a standardized data model to facilitate the subsequent use of these data. One objective can simply be to consolidate similar information across different platform to report and track in a consistent way. The second objective can be to perform independent controls on these data with a defined frequency. The third and more ambitious objective can be to build an independent view of the positions and transactions related to the portfolios under supervision with the goal to use these data for further processing using a consistent set of data.

- The build of an Investment Book of Records (IBOR) with two main potential level of accuracy (positions and transactions only (IBOR lite) or positions, transactions and accruals (Full IBOR ) facilitating the calculation of an independent NAV.

- Workflow processing tools to connect different applications and interconnect with the outside world for the exchange of information, the validation of specific process and the tracking of pending issues across the value chain,

- Web portal supporting electronic signatures. The combination of the Workflow tool and the web portal is essential for example to share constitutive documents or to manage the validation of documents by the different actors involved in the activities of the Trustee,

- Enhanced reporting tools providing the capacity for the end user to define their own ad hoc reporting to get the most useful analysis of the data available.

- New solutions for new requirements that the Depositary/Trustee can easily connect to its existing IT architecture without necessarily opting for a major revamping. One of the most recent example in this domain is ESG monitoring for which there is a massive need of data on top of the capacity to set the rules to check the compliance of the investment made by the Fund within the regulation and the fund guidelines

For PMplus®, these functionality are offered on a Saas Private cloud basis which facilitates rapid ‘Proof of Concept’ (POC) exercises to refine the functional perimeter, the onboarding of the application with the support of the vendor’s experts and the necessary scalability for the application to the evolve with the Depositary’s/Trustee’s activities.

At SuisseTechPartners, we are convinced that the needs of all participants in the Investment Management value chain are converging as there is a need to use and manipulate similar data between the Asset Manager and the Depositary/ Trustee. Our PMplus® solution in its current version already provides the required functionalities as proven by many discussions we have had with important players

in the industry, and we would be delighted to further share our experience, expertise and all of the solutions that we can make available today.