0 < 1 min

Product

Middle-office Technology

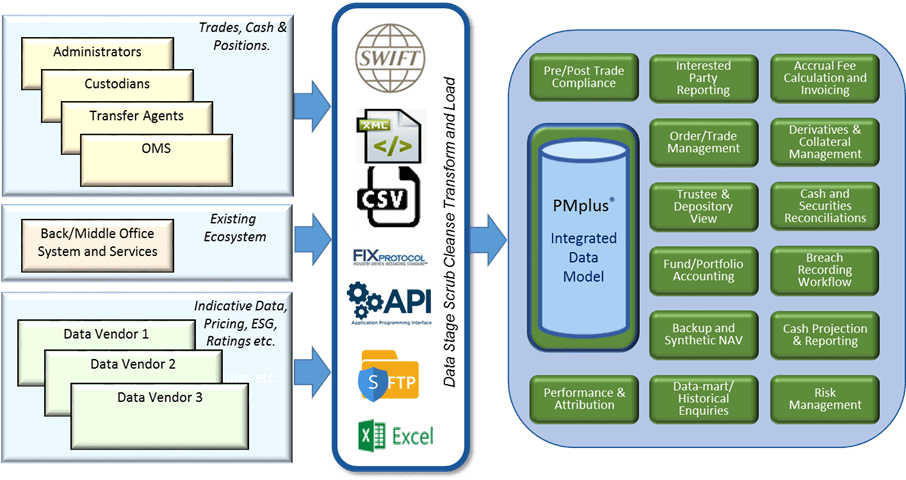

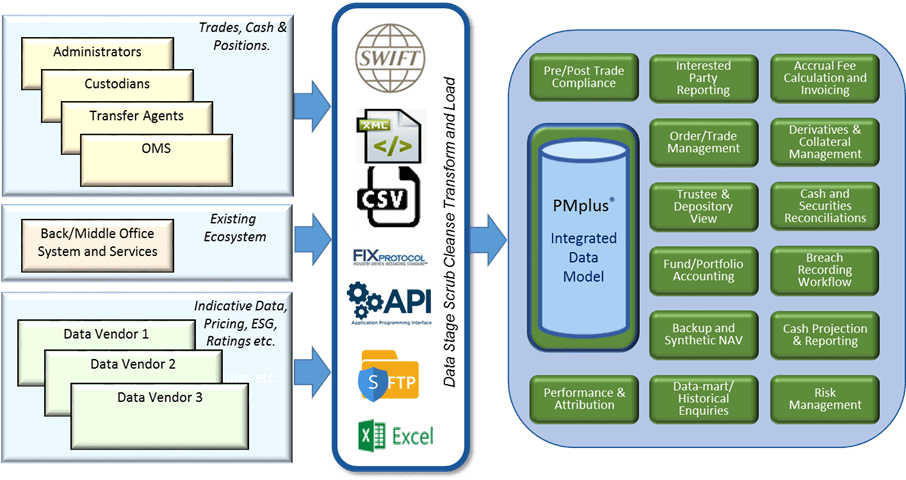

Our integrated “Investment Book of Record” is at the heart of our system

PMplus® incorporates powerful middle-office technology by virtue of its fully integrated ABOR/IBOR functionality. PMplus® collects daily indicative Securities Data/Pricing, Custody, TA and Fund Accounting data via fully automated interfaces, to build independent and reconciled IBOR positions. This includes collecting data from your existing systems to either ease the migration path, or to extend the lifespan of those systems and the associated capital cost. These reconciled positions then drive a large range of functionality, including regulatory ‘Fund Factsheets’ in multi-languages and character sets. Our single data model also provides an ability to consolidate portfolios based on any hierarchical requirement. From these data, a whole range of functionality can be accessed within PMplus®, including:

- Advanced customer report writing;

- Trustee Oversight Dashboards;

- Shadow and Synthetic NAVs;

- Investment Restriction Monitoring;

- Pre/Post Trade Compliance;

- ESG data and breach management;

- Collateral and Cash management;

- Independent Fee and Invoice calculations;

- Counterparty risk reporting; and,

- GIPS Performance reporting and VAR.

It is no longer necessary to connect together different technologies from different vendors into a fragile ecosystem, because PMplus® can provide all the tools that are required by asset managers and asset servicers in one integrated platform, or provide a complement to an existing platform setup.